Insurance Email Marketing Examples And Best Practices For 2026

While some sectors like eCommerce rely on flashy promos and impulse purchases, an insurer’s long-term viability is built on direct, clear, and consistent communication.

Insurance email marketing is the quiet, reliable touchpoint that lets you reach your audience in a non-intrusive way with content they want to receive.

Think welcome emails, claim or policy updates, and renewal reminders that inform and drive retention without sounding like emergency drills.

Knowing which emails to send, when, and what to include in them, can get tricky, though. That’s why in this guide, you’ll find real-life insurance email marketing examples, best practices, and must-have features to create email campaigns that support and guide your clients.

Keep your clients covered, one email at a time

Secure email communication at a reasonable price.

Join MoosendWhy Do Insurance Businesses Need Email Marketing?

Trust and privacy are key in insurance marketing. Random cold calls or social media posts are probably not the best way to win over prospects and clients.

Instead, you need a tool associated with relationship-building, open communication, and compliance, and email marketing can check all those boxes.

This is how it helps you address unique challenges related to your niche:

Building trust with your clients

Insurance, like email marketing, relies on trust to work. Insurance coverage is a difficult decision to make, and it usually takes longer for coverage seekers to become policyholders.

Regular and valuable email content like onboarding material, FAQs, and policy updates allows you to nurture recipients at a slow yet steady pace. That way, you position your business as a credible advisor instead of a policy seller.

Controlling the channel

Unlike other channels, email marketing ensures you can at least reach your target audience. A cold call might not be answered, a brochure might get lost, a social media algorithm might go through changes.

Email works differently since it’s a channel you own and control. When someone gives you their email, they grant you direct permission to contact them. This usually says “I want to hear what you have to share”.

So, email gives you hands-on access to subscriber data. Plus, you’re the one in control of your communication with subscribers instead of relying on intermediaries or trying to decipher algorithm changes to deliver your messages.

And as long as you stick to email marketing best practices, chances are that these messages will get opened and read.

Saving time and effort

Sometimes, insurance agents face time and staffing limitations. But when you invest in solid email newsletter software, you get helpful tools that streamline email creation, customization, and scheduling.

For example, you can access predesigned email templates you can easily tweak instead of building designs from scratch.

Also, email automation lets you send personalized emails at key moments without handling things manually every time. And you can even scale your efforts as your client base grows just by setting up the right campaigns.

Keeping your company top of mind

People don’t wake up one morning and think “I should sign an insurance policy today.” They typically sit with the decision, weighing the pros and cons of each option over a long period of time.

With the right insurance emails, you can keep them informed with real-time updates. More importantly, you have an open line of communication they can use whenever they have questions or you want to ask for feedback.

Ensuring privacy and compliance

Proper data management and compliance with regulatory standards is a requirement in email marketing. This is to ensure you won’t betray your clients’ trust and avoid legal penalties. Let’s see some of the regulations you should adhere to:

Thankfully, modern email marketing platforms make this process easier, letting you access compliance-friendly features. For example, you can build double opt-in lists, include unsubscribe buttons to your emails, safely store and manage audience data, and perform regular list cleaning.

Best Insurance Email Examples and Why You Need Them

Ready to get inspired? Take a look at our top picks of insurance email marketing examples.

1. Welcome emails

As the first touchpoint between your business and new subscribers, welcome emails set the tone for the relationship. It’s also an email type that new contacts expect and, therefore, are more likely to open. So, now is your chance to build trust and authority right off the bat.

A warm, simple welcome note that thanks them for joining may go a long way. But there’s more you can do to grab your subscribers’ attention:

- Introduce your company and team members

- Highlight your services

- Set expectations on future email content and frequency

- Share useful resources that show your value proposition.

- Inform them about the next steps

Just like Better does in this straightforward welcome email:

Subject line: Welcome to Better Settlement Services

Why it works:

- They use the recipient’s name to greet them and a real person to sign the email.

- The general manager’s professional headshot adds credibility to the message.

- They notify subscribers on the next steps while reassuring them that no action is required on their part.

- The clean design with white space and simple structure improves readability.

- They link to a relevant article so recipients can learn more in their own time.

2. Educational emails

Educational emails are the backbone of any successful email marketing strategy. You can use them to send valuable coverage information and proactive tips to address challenges.

Depending on your objectives and target audience, you can decide on a certain email frequency.

Usually, a monthly newsletter will do just fine to keep subscribers engaged. But a weekly cadence could also work if you invest in helpful content and tailored solutions.

Here are a few ideas on what to share:

- Legislatory and policy updates that may affect your clients’ coverage or interactions with your agency.

- Quick tips like financial planning advice or safety checklists for preventing damage.

- Changing industry trends and how they could use new tactics or technology to their advantage, e.g., installing smart home devices for fire prevention.

Below, you have a timely newsletter by Farmers Insurance that kept recipients up to date with new service options during the pandemic:

Subject line: Your Safety is Important

Why it works:

- The clear subject line reveals the objective with an empathetic tone.

- The list of thoughtful solutions, such as offering payment extensions, eases common client headaches.

- The thoughtful email copy focuses on what the company can do for recipients.

- They add two subtle calls-to-action aiming at engaging rather than promoting.

- They include customer support options in detail to save readers’ time from searching online.

- The message comes from the CEO who personally thanks subscribers for their trust.

3. Renewal reminders

While attracting new customers is an important priority, so is retaining existing ones. One of the most effective ways to do that is through well-timed policy renewal reminder emails. Such a campaign helps you reduce customer churn and increase their lifetime value.

The first email should reach recipients a month before the expiration date. Remember, life gets busy and your customers may have a lot on their minds. So, you should offer them enough time to handle pressing matters, such as saving up the money needed to renew.

Send a follow-up email two weeks after that. An effective way to prompt action is to feature customer testimonials and case studies. Alternatively, offer a small incentive like a limited-time discount.

Finally, deliver a last email 2-3 days before the expiration date to serve as the final nudge to renew.

Make sure to add the following information to meet your goals:

- Policy type

- Details and benefits

- Payable amount

- Expiration date

- Relevant resources

- Customer support options

- Quick and simple option to renew

4. Claim updates

Have you ever had that overwhelming feeling before filing an insurance claim? It’s a mix of the shock deriving from the loss or anxiety about health check-ups and the stressful process that comes next.

This is the ideal time to send a dedicated email or series to guide your customers. The goal of these campaigns is to provide all the necessary details so they rest assured they’ve done everything right.

It’s important to turn the process into small, clear, and digestible steps. For example, use your campaigns to let them know:

- Claim information, such as name, policy number, date of claim, etc.

- Their claim status (e.g., pending, approved, or denied)

- The next required steps, such as documents needed

- When to expect a follow-up by a team member

- Contact information to the customer service or the insurer

Keeping them informed also helps you boost customer satisfaction, which, in turn, is an integral part of long-term loyalty.

5. Promotional emails

A targeted promotional email helps insurers drive new clients and repeat business. Their most common use case is to get the word out for limited-time offers or special deals.

But you also have the option to ask subscribers to register for an event or schedule a call with an agent.

For example, you can inform recipients about new coverage options or bundled deals through product recommendations. With the help of segmentation, you can send tailored promotions using each recipient’s policy history and any data at your disposal.

What happens if they’ve already purchased an insurance product? You may send an upsell or cross-sell offer to suggest relevant or additional insurance services and increase your clients’ lifetime value. For example, consider offering a discount to clients who choose to bundle certain policies.

Like in the following insurance email example by Money that targets pet owners to suggest insurance cover for their best friend.

Subject line: Is pet insurance worth it?

Why it works:

- The subject line in the form of a question engages the reader while getting straight to the point.

- The header grabs attention with an emotion-evoking image and a strong, prominent headline.

- They use the power of loss aversion to explain why subscribers need pet insurance.

- They clarify that the cost depends on certain variables, which they make sure to mention.

- The scannable email design uses distinct color blocks and bold headings to separate sections.

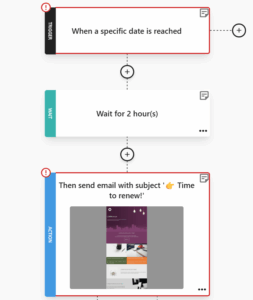

How can you ensure these messages land at the right time? Email marketing automation allows you to create and schedule reminder email sequences. You set a specific date as the trigger, and your workflow handles the rest.

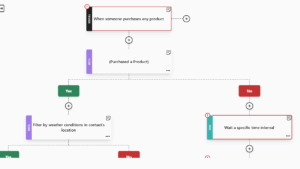

For example, you can use Moosend’s ready-made repeat purchases reminder automation recipe and customize it by adding the details discussed and wording that reflects your tone of voice.

6. Seasonal campaigns

Who’s to say that seasonal emails aren’t for insurance companies? Every industry can leverage relevant national days and holidays to email prospective and existing customers.

For example, here are some occasions to send insurance email campaigns on:

- Car Insurance Day (February 1st)

- National Pet Health Insurance Day (April 7th)

- New Homeowners Day (May 1st)

- National Life Insurance Day (May 2nd)

- National Preparedness Month (September)

- National Fire Prevention Week (around October 9th)

But it’s not just specific dates. It could also be times of the year, such as the summer, back-to-school season, or Christmas. The key is to tailor the message so it suits your industry and your recipients’ life events.

For example, a relevant back-to-school email example could promote renter’s insurance for college students moving into new apartments.

Seasonal content doesn’t always have to be promotional, though. You could send these campaigns to share expert tips so your clients can protect themselves, their loved ones, and their assets against seasonal risks.

For instance, offer travel safety or home security advice during the summer and Christmas vacations. Or just show up to wish them happy holidays.

SoFi sent the following insurance email marketing example a few days before National Insurance Awareness Day. It doesn’t get more relevant than that.

Subject line: NIAD is coming up! (IYKYK…)

Why it works:

- The email CTA and the benefit-focused headline placed above the fold instantly grab attention.

- They use the Z-pattern to break down the three insurance types into clear blocks.

- The action-oriented copy focuses on the outcome instead of the promotion.

- The “Download the SoFi App” CTA is a great way to facilitate mobile users.

- The detailed legal and compliance disclosure serves as a token of transparency.

7. Survey emails

Practice isn’t the only thing that makes perfect. So does customer feedback, helping you identify where you do well and what products, services, and procedures to improve.

On top of that, survey emails are a great source of data that help you dive deeper into their preferences, fears, and aspirations. That way, you can target them with tailored tips, recommendations, and offers.

You can use several survey formats like polls or questionnaires to grasp your customers’ experiences. Whatever you choose, make sure you follow these best practices to ensure a high completion rate:

- Make the process simple: Respect your subscribers’ time by keeping your surveys short with no more than 4-5 questions. Don’t make them go through many steps and choose the multiple choice or NPS format whenever possible.

- Mind the timing: A feedback request email should land shortly after a key interaction, such as a customer support communication, so the action is still fresh on your client’s mind. In fact, 68% of customers say that the timing of the survey increases the chances of completing it.

- Add a small incentive: Customers love to be rewarded for their loyalty. You can offer them a small token of appreciation like a discount on the next renewal or a free entry into a giveaway. Ensure the incentive is clear and prominently displayed so they don’t miss it.

- Act on their insights: If you ask for customer feedback to improve, then you must stick to the promise. Also, consider sending a follow-up email where you explain how you used their input to optimize your services.

In this insurance email marketing example by Insurify, the feedback request is as easy as it gets:

Subject line: Thank you + quick question

Why it works:

- It serves the purpose perfectly by leaving out excessive text or additional CTAs that could distract recipients.

- The email subject line aligns with the appreciative and concise copy.

- The single question in NPS format is friction-free since the subscriber can answer it quickly without leaving the email.

8. Milestone emails

There are moments in the customer journey that go beyond sales and deals, such as celebrating a client’s birthday, a business anniversary, or a claim approval. Enter milestone emails. These campaigns should focus on strengthening connections and making clients feel appreciated.

An insurance agency may have a comprehensive customer profile at their disposal. This translates into more opportunities to engage them with such a campaign.

So, if your records show an exciting life event like a marriage or a new home, send such a campaign just to say “congratulations”. But you can always take it one step further.

Let’s say your customer just got married. You can check in to ensure their existing policy covers their changing needs and suggest an upgrade if needed. To sweeten the deal, offer a small discount to show you’re not just words.

However, make sure it doesn’t feel like a hard sell but a subtle way to get them from point A to point B.

Also, it’s important to only use this information if it was provided directly by the policyholders. Data privacy should never come as an afterthought since violating it might become a dealbreaker for subscribers and a breach for email regulations.

It doesn’t take much to create a milestone email. You can customize a predesigned template so you don’t have to worry about spending too much time on it or learning how to code.

Moosend’s newsletter template library offers a range of designs for different use cases:

So, pick the design that serves your needs, and adjust it with a few clicks. For example, you can add festive animated images like a key for their new house. Or their personal agent’s signature for a human touch.

Insurance Email Best Practices

The insurance email examples we shared have something in common: they use email best practices to ensure engagement and conversions. Let’s see what you should do to follow their lead.

1. Make compliance your top priority

Insurance businesses should, first and foremost, comply with data protection and privacy laws, such as GDPR, GLBA for financial institutions and service providers, or HIPAA for healthcare email marketing.

Permission-based email marketing isn’t just about staying away from legal trouble. It’s mostly about respecting your audience and their personal information and fostering trust.

Here’s what you need to do to achieve it:

- Don’t use any misleading tactics in your subject lines like adding RE: to let recipients think the email is a response when it’s not.

- Set up a double opt-in process to ensure subscribers confirm their email addresses during signup. That way, no mistyped or fake address will enter your list, which helps you keep it clean and free of spam traps.

- Always include a clear and visible unsubscribe button in your email campaigns.

- Include your physical address and contact information for credibility.

- Avoid showing sensitive information directly in the email. Instead, use links to direct them to secure portals.

- Inform subscribers about any regulatory updates affecting their coverage or changes in policy and billing terms.

Besides following these best practices, you also need to choose email marketing software that takes care of certain things for you.

Everything starts with role-based access that allows you to control who can view and manage sensitive customer data. This minimizes the risk of mishandled policy data or unapproved sends.

You’ll also need automatic list management, for example to move subscribers who opt out into a suppression list. Dynamic segments are another helpful feature you can use to group recipients based on their preferences so they only receive relevant emails.

On top of that, your email marketing platform must offer options for subscribers to update their preferences. This process involves setting up an email preference center so they can select the email types (e.g., policy updates, newsletters, claims workflows) and adjust the frequency.

With these in mind, your clients will know you’re doing your best to safeguard their data and inboxes. As a result, they feel more confident when interacting with your business.

2. Craft clear and engaging email subject lines

What’s the first thing you see when you receive an email? That’s the subject line, the element that impacts whether you’ll open the campaign. If it’s generic or boring, chances are you won’t.

To get your campaigns opened, you should start by keeping your subject line short, simple, and focused, preferably under 50 characters.

Also, avoid confusing recipients through misleading subject lines. Instead, use descriptive copy that conveys the email purpose. For example, write “Important update about your car insurance” instead of “Important news.”

Lead with value and risk-mitigation benefits rather than choosing urgency or aggressive sale messages. For example, write “How to protect your home during the storm season” instead of “Limited-time offer.”

On the same note, use personalization beyond the recipient’s name, for example by referencing recent policy activity (e.g., “Here are the next steps for your claim”). You could also ask a question to evoke curiosity, such as “Need help organizing insurance paperwork?”

Emojis in subject lines are great to catch attention, but you’d better avoid them if they don’t fit your brand identity or campaign goal, like in the case of a claim update. Last but not least, don’t include spammy words like “guaranteed” or “money” since they may trigger filters.

3. Use pre-built email templates

Not all insurance businesses have dedicated marketing teams. With ready-made email templates, you save time from email creation while ensuring professional look and feel. Plus, you can involve more team members, even those with no coding skills, and easily scale your email marketing efforts.

Most email solutions offer premade, mobile-responsive templates that you can tweak using a drag-and-drop builder. Such a tool simplifies tweaking the layout, removing or adding components, or uploading your branding assets to keep every campaign visually consistent.

What you leave out or include depends on your email purpose. For example, you can:

- Incorporate a countdown timer to a renewal reminder email to display the time left before the policy expires.

- Insert a survey block into a feedback email so you can learn more about a customer’s experience with your agent or whether current coverage meets their needs.

The best part? If you created an email design that you love, most email tools like Moosend allow you to save it as a template and reuse it in future campaigns.

4. Opt for simple and customer-centric messages

Your customer always comes first. Turn your focus and email copy on them and consider how you can serve them better.

Start by using clear and simple language. Remember, your subscribers aren’t insurance experts, so keep your emails free of industry jargon and complex terms they’ll have to search online. Why use “endorsement” when you can simply say “policy change?”

Also, place critical information first. For instance, if they have to upload an extra document for a claim, mention that first and give them clear, actionable instructions. It’s equally important to avoid unnecessary information and instead focus on concise wording that gets them to the next step.

When insurance is involved, any occasion could be stressful. It’s not only diseases or natural disasters, but also scenarios like buying a new car or preparing for a trip.

Therefore, your insurance emails should quickly address pain points and provide solutions. Do you want to promote an add-on? Then, frame it as a must-have upgrade because it will save them time, money, or trouble.

For example, you could include a peak-travel checklist and then present one of your products as the solution to a potential setback, e.g., a missed-connection benefit that covers overnight accommodation.

This insurance email example by Blue Shield of California uses actionable and caring copy, digestible sections, and helpful resources to help subscribers stay healthy during fall.

5. Segment your email list

Nobody needs a generic email. That’s why it’s important to segment your list. With email segmentation, you divide your list into smaller, targeted groups based on shared characteristics like demographics, behavior, and preferences so you can send personalized emails.

Every insurance customer has unique needs depending on characteristics like their age, stage in the customer journey, or income.

But which segmentation criteria make sense for insurance emails? Let’s check a few ideas:

- Policy type (health, life, home, car)

- Claim history

- Behavior and engagement (renewal links clicked in email)

- Stage in customer journey (new prospect, policyholder, disengaged customer)

- Seasonal risks in the recipient’s location

You can access this kind of information right from signup through a targeted subscription form. Users may fill in information like their name and location, policy types, content they’re interested in, or preferred communication channels.

As time goes by and they engage with your brand across multiple touchpoints, you can easily collect more data that will guide your email personalization efforts.

For instance, when Hellas Direct visitors ask for a quote, they must share details like their birthday, location, and whether they’re an individual or company representative:

6. Personalize your email content

After implementing list segmentation, you’ll have enough data to customize your email content.

Email personalization can be something as simple as referencing your customer’s current coverage plan and sharing relevant information like legal terms or upcoming changes.

If your email platform offers behavior-based triggers, you can send personalized messages that feel relevant to a recent subscriber action.

So, if a website visitor browsed a pricing page on critical illness coverage, share a downloadable resource explaining common conditions covered. Delivering such a personalized email after an interaction feels more like a tailored service than a marketing message.

Dynamic content is another powerful feature, letting you display different blocks to each subscriber based on their demographics or needs.

For example, people with life insurance policies will see a section reminding them to update their beneficiaries. Whereas those with travel coverage will get instructions for submitting claims quickly.

7. Automate for common campaign types

Automated campaigns allow you to reach every recipient with tailored and timely messages based on specific triggers. These involve their actions, key moments in their journey, or dates reached.

Some of the most common events triggering an automated email or sequence include:

- Signing up for newsletters

- Filing claims

- Requesting quotes

- Browsing add-ons

- Opening or not opening emails

- Buying a policy

- Communicating with an agent

Depending on the triggers you set, you can send an email campaign in response to your customer’s behavior. With email automation tools, you deliver the right message at the optimal time, such as follow-ups after sending a personalized quote.

Insurers can automate workflows like onboarding sequences with thank-you notes, policy details, and reviews to showcase outcomes in a tangible way. You can also use claim update sequences to inform subscribers about the next steps and the progress of their claim and ask for feedback.

You may even use the weather conditions in the subscriber’s location to trigger a tailored promotion. Let’s say a subscriber has just bought basic car coverage and lives in a region with a severe storm forecast.

Using Moosend’s weather-based upsell recipe, you could send an offer for a more comprehensive plan that covers damages caused by natural phenomena.

There’s a catch, though. Just because trigger emails are pre-scheduled, it doesn’t mean it’s ok to sound robotic. Make sure to reference their actions in the email and add personal touches whenever possible.

8. Leverage AI-powered writing assistants

Even experienced content writers face writer’s block. Let alone if email content creation comes on top of claim and customer inquiries management.

This is why AI in email marketing has become a thing, and many email solutions now have built-in AI writing assistants.

These tools allow you to craft email subject lines and copy in a few minutes. You can also ask them to:

- Proofread your email copy and remove any grammar or spelling mistakes.

- Adjust the tone to fit your brand voice and industry requirements (like balancing professional with positive, friendly language.)

- Explore new topic ideas or fresh angles, such as highlighting common mistakes when filing claims.

- Restructure complex ideas like claim timelines, into simpler, easy-to-grasp messages.

- Translate your messages to reach global audiences more effectively, an option offered by specific platforms like Brevo.

There are even free optimization tools like Moosend’s AI writer that helps you create, proofread, and refine your email, landing page, and subscription form copy. You can also use it to experiment with different tones and text lengths and come up with the most engaging version.

While AI proves to be a major asset in email creation, always remember that it can’t build authentic connections.

This is still a job destined for human marketers who should use their innate creativity to get into their clients’ shoes and create emails that evoke emotions. That way, your subscribers can relate and understand that a real person is behind the campaign.

9. Perform A/B testing

Even minor adjustments may play an important role in how subscribers interact with your emails. A/B testing allows you to experiment with email components and identify what works best for your subscribers, leaving guesswork out.

With A/B testing, you compare two email versions that differ in one element, sending them to smaller segments of your list to see which brings better results to optimize your email campaigns. It’s important to test one variable at a time to have a clearer understanding.

For example, test a straightforward subject line (e.g., “Your life insurance policy is about to expire”) against an urgency-focused one (e.g., Two days left to renew your life insurance policy”). Once the results are in, the winner is automatically sent to most of your subscribers.

Email marketing platforms offer A/B testing features so you can check the performance of various components, such as your subject lines, email copy, layout, CTAs, or product recommendations.

10. Monitor and adjust

It’s impossible to refine what you don’t track. This is why you should regularly monitor key email metrics like click-throughs, conversions, unsubscribes, and subscriber lifetime value to tell what works in your strategy and where tweaks are needed.

For example, if you notice low click-through rates, your email content and promotions might not be compelling enough. Or a cluttered design may discourage subscribers from reading.

Meanwhile, high unsubscribe rates may be a sign of poor list hygiene or excessive frequency, which can both damage your deliverability in the long run.

To help you keep track of key engagement metrics, robust email software comes with detailed and easy-to-read reports. Besides all-time-classics such as opens and clicks, some platforms let you access insights like activity by device, email client, or location.

There’s also real-time reporting, like Moosend’s click maps, that show you which links and email sections received the most engagement.

The platform also allows you to create custom reports, where you select the metrics that matter most. Top products and campaigns, as well as best-performing days, times, or senders are some of the widgets to choose from while tracking performance through an intuitive dashboard.

You can also read our case study to see how InsuranceMarket created their unique reporting dashboard using Moosend’s API.

Take Charge of Your Insurance Emails

After checking our favorite insurance email examples, you may be tempted to experiment with many email types at once to see what sticks. However, we suggest you decide on the most essential campaigns, use the best practices and tools mentioned, and then add more workflows to the mix.

So, choose an email automation solution that takes care of everyday tasks so you can focus on what you do best. You can get started by signing up for a Moosend account and use email automation, personalization, and analytics to build and optimize your emails.

That way, you’ll have all the time you need to focus on what you do best: protecting what matters most to your customers and providing them with the best solutions.

FAQs

Here are the answers to common questions regarding insurance emails:

1. What are the most important elements of an insurance email?

An effective insurance email should have a simple subject line that clearly shows what the email is about, plus content that aligns with the subscriber’s interests and lifecycle stage. You also need a prominent and straightforward CTA, your contact information, and a clear unsubscribe option to ensure compliance with privacy laws.

2. What kind of content should you prioritize in insurance email marketing?

You can combine different content types, such as quick tips, policy updates, seasonal campaigns, and exclusive deals. Monitor which emails resonate most with your subscribers and keep an eye on competitors for inspiration. Avoid reaching out only when you’re trying to drive a renewal or sale. You need to stay connected with subscribers through non-promotional campaigns like milestone or educational emails. That way, you show them that you’re not just interested in the transaction but also care to provide value.

3. What challenges do insurers face when creating emails?

The biggest challenge involves handling sensitive information and complying with data privacy and security regulations. Insurance emails could also include complex terms, which may result in miscommunication and customer frustration. Finally, striking the right balance between professional and engaging content can get tricky.

Published by

Published by